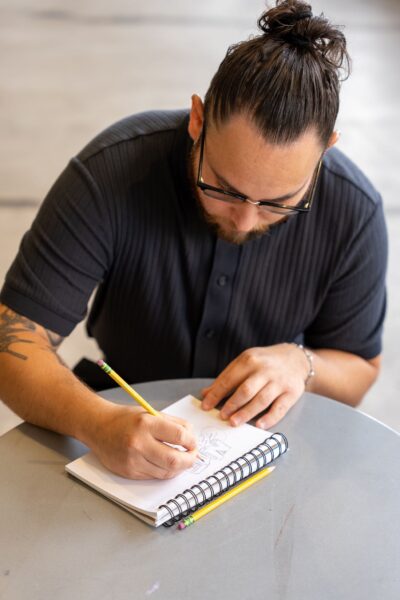

Success Story

FREE FINANCIAL PLANS IN JUST FIVE MINUTES

After building a successful business with the support of SBDC resources between 2014 to 2017, Spencer Barclay knew he would go back to them when he was ready to start another company. In February 2019, that time came.

Barclay observed that many millennials struggle with their personal finances. He knew this was a problem he wanted to solve, but he wasn’t exactly sure how to do it.

Turning to the SBDC for assistance, he started to brainstorm business plans. He knew they could help him tap into the broader entrepreneurial ecosystem in the valley and help him apply many of the business concepts he had learned.

Counselors and other entrepreneurs were eager to help. These interactions prompted Barclay to perform broader market research to find and validate a business model. He ended up doing thousands of surveys, hundreds of one-on-one interviews, and dozens of small focus groups. Over several weeks, his ideas became more focused as he discovered a few key concepts from his market research.

Barclay outlined a business plan for financial planning. He and his team adopted a mission to increase the financial security for digital generations by making financial planning more accessible, more actionable, and more effective than ever before. He summarized his business in a clear and concise introduction, “At Savology, we provide free financial plans in just five minutes.”

When Barclay was ready, local SBDC advisor Jim Beckstrom, who he worked closely with, invited him to a pitch event where he met a group that became Savology’s first venture investors.

Years later, when she started to hear about zero waste stores, she thought, “That’s my idea!” This lit a fire under her, and she began working toward opening her own business in Utah.

After months of development, Barclay built a team and launched their fast and free financial planning technology. He stayed in touch with Beckstrom to keep him apprised of their progress. After establishing a few months of traction, Savology was able to raise a $750,000 seed round to accelerate their growth. The company has since created jobs for several families, built financial plans for tens of thousands of households, and partnered with dozens of industry leaders.

Savology’s connection to the SBDC continues to this day. The SBDC helped them secure office space nearby where they can meet intermittently to consult and solve problems. Savology is building off a strong foundation and is well on its way to reach the goal of increasing the financial security of millions of American households.

Business Assisted by The SBDC At: